What is carding? This is a question that a lot of people usually ask. Carding is the term used for credit or debit card fraud. This occurs when someone uses a stolen or fake credit or debit card to make unauthorized purchases. In recent years, there has been an increase in online carding scams. This is because it is easier for criminals to commit this fraud online. In this blog post, we will discuss what carding is and how you can protect yourself from becoming a victim of this type of scam.

Carding in details

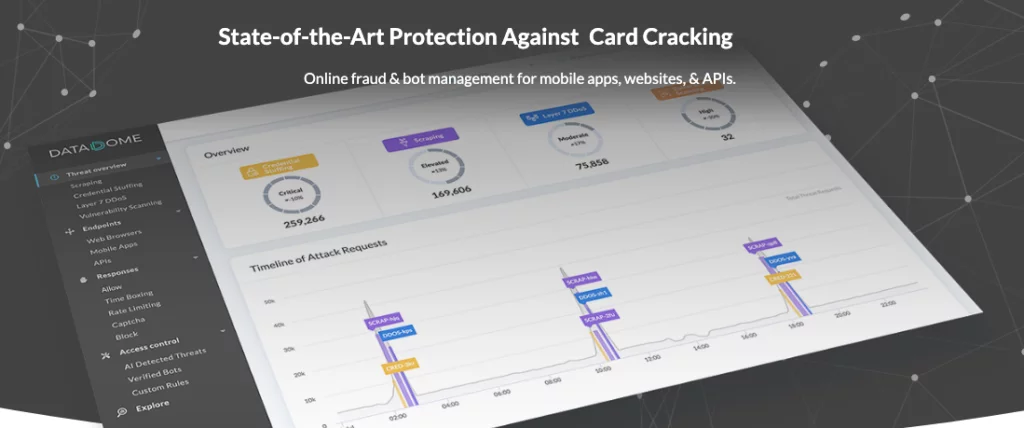

Carding is a type of online fraud involving using stolen credit card information to make unauthorized purchases. Carding most often occurs on e-commerce websites, where criminals will use stolen card data to create fake assets. This type of fraud can be complicated to prevent, as it often relies on bot-driven automation to bypass security measures.

In many cases, carding can only be detected after a purchase is made with a stolen credit card. However, some ways prevent carding from occurring in the first place. For example, e-commerce websites can implement measures to detect and block automated attempts to place orders using stolen credit card data from happening.

Additionally, law enforcement can work to identify and apprehend those who engage in carding. By taking these steps, we can help to reduce the incidence of this type of online fraud.

How carding bots works

Bots are computer programs that can automate online tasks. In the context of online fraud, carding bots are used to automate the process of stealing credit card information. Carding bots are programmed to crawl websites and collect data such as credit card numbers, expiration dates, and security codes. This information is sold on the black market or used to make fraudulent purchases.

Carding bots constitute a significant problem for online retailers and financial institutions. They cause billions of dollars in losses yearly and are challenging to detect and prevent. There are many ways of preventing bot-driven carding. Some of them include:

- Use a secure browser extension like Privacy Badger or uBlock Origin. These extensions block third-party trackers that collect your data

- Use a credit card with fraud protection. Many credit cards offer features like zero liability for unauthorized charges

- Monitor your credit card statements for unusual activity. If you see something suspicious, report it to your bank or credit card issuer immediately

Ways to detect card fraud

There are many ways to detect card fraud, but these ten methods are some of the most common and effective. Using a combination of these techniques can help protect your business from fraudulent charges.

- If you see a charge that looks out of the ordinary, call the customer service number on the back of the card to verify the order. If you suspect a card may have been stolen, report it to the police immediately.

- Another way to detect fraud is to check for unauthorized transactions on your statement. If you see any charges that you don’t recognize, contact your credit card company right away.

- You can also monitor your credit report for any suspicious activity. If you see anything unusual, such as a new account opened in your name, contact the credit reporting agency right away.

- Another way to detect card fraud is to sign up for alerts from your credit card company. These alerts can notify you of any suspicious activity on your account, such as a large purchase made without authorization.

Ways in which carding in service of online fraud occurs

Regarding online fraud, carding is one of the most common methods used by criminals. Here are ten ways in which carding can be used to commit online fraud:

- One of the most common ways that carding is used to commit online fraud is by using stolen credit card numbers to make purchases on websites. This can be done by either using the stolen credit card number to make a purchase directly on a website or by using it to purchase an intermediary service such as PayPal.

- Another common way is using stolen credit card numbers to fund online accounts. This can be done by setting up fake accounts using the stolen credit cards and then using these accounts to make purchases or to withdraw money from ATMs.

- Carding can also be used to commit online fraud by using stolen credit card numbers to make donations to charitable organizations. This is often done by setting up fake donation websites using stolen credit cards and soliciting contributions from people who think they are helping a good cause.

- Criminals can also use carding to commit online fraud by creating fake profiles on social networking websites and friending people to collect their personal information. They can then use this information to make purchases or apply for credit in their name.

Ways to prevent online fraud

You can do a few key things to help prevent online fraud.

- Ensure a solid and unique password for each online account. A combination of upper and lower-case letters, numbers, and symbols is an excellent way to create a strong password.

- Be cautious about the links you click on and the emails you open. Fraudulent emails will often trick you into clicking on a link or downloading an attachment by pretending to be from a legitimate source. If you're unsure about an email, contact the company directly to confirm its validity before taking further action.

- Beware of phishing scams. These scams typically involve someone posing as a legitimate company to get you to share personal or financial information. Be sure only to enter your information on secure websites. Look for the "HTTPS" in the address bar.

- Keep your software and antivirus programs up to date. Regularly installing updates will help protect your computer from the latest security threats

- Be careful about what you post online. Avoid sharing too much personal information on social media or other public forums

- Use a credit card rather than a debit card for online purchases. Credit cards offer more protection against fraud than debit cards because you can dispute fraudulent charges and get your money back.

- Monitor your credit report for any unusual activity. You can get a free copy of your credit report from each of the three major credit bureaus once per year.

- Watch out for fake websites. Fraudulent websites may look identical to legitimate ones but often have slightly different URLs or misspellings in the address. Double-check the URL before entering any personal information on a website.

- Don't respond to unsolicited requests for personal information. Legitimate companies will never ask you for sensitive information like your Social Security number or bank account number via email or phone.

- Consider signing up for a fraud alert or credit freeze. A fraud alert allows creditors to verify your identity before extending credit in your name, while a credit freeze prevents new creditors from accessing your credit report altogether.

- Implement browser validation. Browser validation is a process of preventing bot-driven carding by verifying that the user's browser is legitimate. This is done by checking the browser's user agent string and comparing it to a list of known user agent strings. If the browser's user agent string is not on the list, the browser is considered illegitimate, and the request is blocked. Browser validation can also block requests from known malicious browsers, such as those used for web scraping or click fraud.

- Implement reputation analysis: To prevent carding attacks, reputation analysis can identify and block IP addresses associated with known botnets. This helps to ensure that only legitimate traffic is allowed access to the site, preventing fraudsters from using carding attacks to steal sensitive information.

- API security: Implementing security measures at the API level by requiring a CAPTCHA for payment submissions, rate-limiting requests, and using IP blocking to prevent repeat offenders.

- Multi-factor authentication: Multi-factor authentication, also known as two-factor authentication, is a security measure that requires users to present more than one form of identification when logging into an account.

The most common form of multi-factor authentication is a combination of something the user knows (such as a password) and something the user has (such as a physical token or a biometric scan).

By requiring multiple forms of identification, multi-factor authentication makes it much more difficult for unauthorized users to access an account. This is especially important in preventing bot-driven carding, a fraud that uses automated software to guess login credentials.

Taking these precautions can help you avoid becoming a victim of online fraud. Remember, it probably is if something seems too good to be true. Stay safe out there!

Conclusion

We’ve looked at how bots are used to collect and distribute credit card data, as well as how they are used to carry out fraudulent transactions. As online retail continues to grow, businesses must be aware of the various threats posed by bots and take steps to protect themselves against these attacks. There you have it – everything you need to know about carding and bots!