1. Overview: Job Responsibilities, Salary, and Common Requirements

2. A Comprehensive Guide to Becoming an Accountant

3. What Does an Accountant Do?

4. Signs You Should Consider Becoming an Accountant

5. How Do You Become an Accountant?

6. What are the Knowledge and Skills Needed to be an Accountant?

7. Popular Schools and Colleges in the U.S. for Aspiring Accountants

8. How to Get a Job as an Accountants

9. Learn About Geographic and Location Pay Differentials

10. Make Your Resume Stand Out

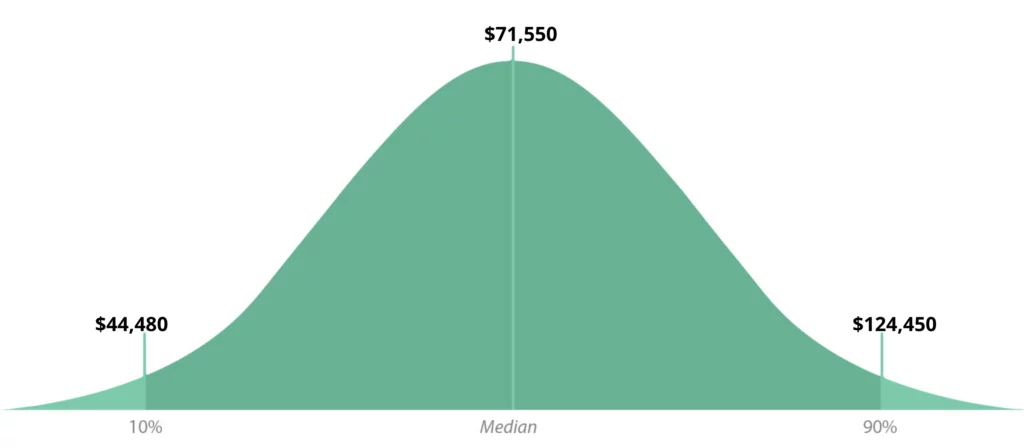

Accountants made a median salary of $71,550 in 2019. The best-paid 10 percent made $124,450 that year, while the lowest-paid 10 percent made $44,480.

Accounting Assistant

Accounting Clerk

Accounting Manager

Accounts Payable Clerk

Accounts Receivable Clerk

Bookkeeping

Budget Analyst

Payroll Clerk

Staff Accountant

Tax Accountant

Quickbooks

Microsoft Word

Microsoft Powerpoint

Accounting

Microsoft Excel

Lacerte

Accounts

Payable/Receivable

Microsoft Access

Peachtree

Below is a list of the Top 50 Accounting Universities in The USA from The Big 4 Accounting Firms.

Perhaps you are asking, “is accounting a good career?” The answer is, “yes.” Accountants are one of the greatest assets in a company. They ensure that financial records, such as debts, profits, and liabilities, are accurate and well-maintained. They are also responsible for tasks such as analyzing data, finance reports and accounting records, performing audits, preparing taxes and tax returns, and providing consultations.

According to the Bureau of Labor Statistics (BLS), the median annual salary of an accountant is $71,550 as of 2019, and it is also projected that there will be a 4 percent increase in employment from 2019-2029.

To be an accountant, one must have a high degree of integrity, dependability, and trustworthiness because they are dealing with money – and sometimes a significant amount of it.

Accountants have an important role and contribution when it comes to the financial decision making of an individual or a business. Since they are responsible for maintaining the financial record, they can provide input on how to help with risk management and even assist with the implementation of business strategies. They also help reduce or control the cost of business by preventing misuse of the assets and controlling the budget. An accountant’s duties may vary depending on his/her specialization and job sector.

An accountant’s duties may include:

Accounting is one of the most respected and promising professions with job security and opportunities for advancement. You can choose to work in general practices such as:

You will also have an opportunity to use and hone your problem-solving skills, leadership, communication, team building, time-management, and more.

The U.S. Bureau of Labor Statistics shows that accountants’ employment is projected to grow 4 percent from 2019 to 2029, faster than the average for all occupations.

“Why accounting?” and “Is accounting a good career choice?” may be one of the first questions you ask yourself if you are planning to start out in this field. To help you find out if this career path is for you, here are the top pros and cons of an accounting career.

This is a career that is going away anytime soon. Businesses need an accountant or an entire accounting team. As long as taxes, money, and businesses exist, people will need help from accountants.

One of the main reasons to consider a career in accounting is the salary. According to the U.S. Bureau of Labor Statistics, the median annual wage for accountants was $71,550 in May 2019. The salary range varies as to your level of experience, location, education, and job description.

You can pursue numerous career paths with an accounting degree. You can take control of your career and future. Pursuing accounting gives you a much clearer career path compared to other careers where the potential career outcomes are harder to define. You may start in an entry-level position as a staff accountant. Once you have gained experience, you may want to gain additional qualifications like becoming a Certified Public Accountant (CPA), which is a well-respected credential.

Even after you have completed a degree and become a CPA, the learning doesn’t stop because you need to plan on continuing education for you to progress in your career. After getting a degree, you need to choose what licenses or certifications you might want to earn. This takes a significant amount of time and effort to obtain.

If you have a passion for numbers and accounts, then this career will definitely appeal to you. However, if you don’t like tedious tasks that require a lot of math and investigation, this career might sound boring to you.

Your duty is to organize a company or individual’s finances. The more money you work with, the more pressure you will be experiencing, and this is a usual part of an accountant’s job. So before you decide to pursue an accounting career, you should prepare yourself so that you can handle stress and pressure because these can negatively impact your mental health.

Do you have what it takes to be an exceptional accountant? These are the key qualities that make a successful accountant:

Being proficient in mathematics is one skill an accountant will need to be successful in the chosen field. Some accountants these days rely on calculators and spreadsheets when doing computations, but we shouldn’t rely on technology 100% because there is always a possibility for inaccuracy. That is why accountants should be efficient with numbers to double-check and ensure accuracy.

If you are meticulous about accuracy and details, then being an accountant is the right career for you. Being attentive to details is an important trait an accountant should have because they need to make sure that all of the numbers they are working on their documents are correct. To become detail-oriented, they should develop their sense of focus as this will reduce the risk of making mistakes. The smallest mistake could equal huge consequences, so when performing tasks such as preparing a financial statement and report, all of the information included should be accurate and error-free.

Accountants must demonstrate strong organizational skills. They must be able to stay on top of everything because they are dealing with a lot of paperwork. Accountants must also have easy access to documents they might need, which will help them optimize their productivity and work accurately. They usually manage this by maintaining a system that will help them keep track of the accounts and transactions they handle.

Having strong analytical skills is what helps accountants use logic to solve problems. They read, analyze, compare, and interpret numbers to help individuals or organizations manage and understand their accounts and finances. They use this skill to solve mathematical problems, perform critical thinking, problem-solving, and plan formulation.

An accountant’s role is critical to a company. Accountability makes an accountant obliged or legally responsible for doing the part of his/her job professionally. Since they are dealing with the financial statements of an individual or an organization, they need to make sure that these records are accurate. Financial statements’ inaccuracy may cause the responsible party to pay for any losses or even face legal consequences.

Accountants live by their credibility. They establish a good reputation by being reliable and trustworthy. Dealing with an individual or organization’s financial statements and financial health should be a confidential topic to protect their security. Clients trust their accountants that they will not take advantage of them or suddenly go in the wrong direction.

You can take different paths to become an accountant, depending on the type of accounting career path you want to pursue. However, there are basic requirements that you should complete to become successful in any of those accounting career types.

Most companies consider a bachelor’s degree in accounting or any related field such as business administration as a minimum degree to be an accountant. You also need to earn a bachelor’s degree if you are planning to be a certified public accountant (CPA).

Each state has its own requirements; some states may even require you to take additional coursework such as tax accounting, financial reporting, auditing, and even marketing and finance. Asking advice from an academic counselor would be a great help before you enroll in a degree program.

So what are the future career choices for accounting students? Accounting features four career types: Public Accounting, Private Accounting, Internal and External Auditing, and Government Accounting. Within those four sectors are a series of unique career paths and positions you can choose from.

This type of accountant offers his/her services to an “external” or third-party individual or company. They usually choose to work as freelancers and sole-proprietors and even accept offers of joint partnerships. They also work with accounting firms and government agencies. To sum up, they work with several clients and are not solely employed by only one client.

A public accountant’s services include, but are not limited to:

To be a public accountant, you must have a bachelor’s degree and a Certified Public Accountant (CPA) certification.

This type of accountant offers their services “internally” or to only an individual, one business entity, or a specific company. Since they exclusively work for one client and focus on one field and in one type of service, it allows them to become more familiar in that area, developing a higher level of financial expertise in that field.

They are hired internally and are responsible for performing various tasks depending on the requirements of their clients. As a result, they have a wide knowledge of the specific industry’s business requirements and processes; therefore, they become more familiar with tasks such as accounts payable, accounts receivable, cash flow, payroll, billing and manufacturing costs reports, etc.

Being a Certified Public Accountant (CPA) is not required for this position, although it is preferred.

This type of accountant works in government agencies, offices, or public sectors such as the General Accounting Office, the Internal Revenue Service, the Federal Bureau of Investigation, the Securities and Exchange Commission, as well as government offices. They also have an understanding of the accounting principle that is set by the Governmental Accounting Standards Board (GASB).

A government accountant’s services include, but are not limited to:

Becoming a Certified Public Accountant (CPA) is a must if you want to pursue this path in accounting.

One of the internal auditor’s main objectives is to improve an organization’s operation by reviewing its activities and reducing risks. On the other hand, an external auditor’s objective is to validate the accuracy of an organization’s financial records and accounting methods if there are irregularities.

An internship can help your resume stand out. Undergoing an internship will help you gain firsthand experience of the common duties and responsibilities of an accountant. This is enormously important since employers prefer hiring someone who has experience.

You can ask your school’s accounting department to give you a list of accounting firms or other local businesses with an existing partnership. If your school doesn’t offer this kind of program, you can ask for your accounting professor’s network. Also, you can find internships online. Many companies are looking for interns, and they commonly post available internship positions online.

To become a CPA, one must pass the examination and meet specific requirements like having a minimum bachelor’s degree at 150 semester hours of credit.

Being a CPA brings you more opportunities aside from helping you earn more because it shows that you have the expertise in the field. You can perform certain legal services such as filing reports with the Securities and Exchange Commission (SEC), and you can even start your own firm. It also gives assurance to the public and your clients that you are credible and that you have achieved the required education, training, and experience that is essential in performing your duties.

As an accountant, you must understand the Generally Accepted Accounting Principles (GAAP). These accounting standards are a set of rules and practices used throughout the accounting industries. All regulated, publicly held, and publicly traded companies are obliged to follow the GAAP standard.

Accountants create formal records of the financial activities of an individual or organization, which are generally called financial statements. Financial statements include balance sheets, income statements, cash flow statements, and shareholders’ equity statements.

Accounting and economics go hand in hand when dealing with financial issues. Both are also involved with a lot of numbers and computations; thus, knowledge and skills in mathematics are a must. Also, both skills are concerned with the same interest: goods and services.

Skills in accounting and economics are essential if you want to become a successful accountant. The main focus in economics is the production, consumption, and distribution of wealth, goods, and services. On the other hand, accounting is analyzing, summarizing, and recording financial transactions.

Accountants use spreadsheet software or program these days to analyze, organize, and store data. This type of software replaced the old paper accounting worksheets; thus, tasks became easier. This tool can be used to automatically calculate mathematical problems by manipulating data with formulas and commands. They can also use this software to review past, present, and future performance or trends.

This is the process of matching sets of records between two accounts to ensure that the information of funds going out of the company matches the actual money spent. The account reconciliation process is done before the end of a particular financial period. If the accountants find discrepancies in the account balances, they will perform investigations and take corrective action to rectify the inaccuracies.

Most companies have at least one accountant in their team. Accountants are responsible for the reporting, recording, and analysis of business transactions. According to the Bureau of Labor Statistics (BLS), accountants’ employment is expected to increase 4 percent from 2019 to 2029. The BLS also reported in 2019 that the median annual salary of an accountant in the United States is $71,550.

Although employment growth is quite high, finding a job as an accountant can still be a challenge.

How can you get a job as an accountant, and what are the key requirements to be successful in the accounting field?

First, you must complete a bachelor’s degree in accounting or any related field. You should also maintain a GPA of at least 3.5 or higher to have a chance to position yourself with major companies such as:

Second, you must gain hands-on experience. This is by enrolling in an internship or doing volunteer work. Getting hands-on experience is as important as having a degree because you will have a chance to be exposed to the field. Thus, you’ll be able to acquire the knowledge and skills that will make you a more competitive candidate in the job market.

Third, you must pass the Certified Public Accountant (CPA) exam.

Most companies and firms prefer hiring candidates who are CPAs. These are some reasons why you should consider becoming a CPA:

1. More career opportunities. You can choose to work for a government agency or a private company.

2. Recognition. Gaining the CPA title, the highest level of an accountant, is not easy. You will be respected and admired by your peers, clients, and employers because it shows that you are a professional and that you are dedicated to your profession.

3. Guaranteed employment. Since most employers prefer CPAs over non-CPAs, many companies would rather retain their CPAs and companies who would rather hire CPAs. You can also work on your own or even start your own company if you earn a CPA license.

4. Higher pay. The Association of International Certified Professional Accountants (AICPA) conducted a survey, and the results show that a licensed CPA earns about $66,000 to $152,000 in annual pay.

The CPA exam has four four-hour sections:

You can take these exams within 18 months, and you need to at least have a score of 75 on each section to pass. However, take note that every state issues its own CPA certificate. Thus, there are different rules and requirements. Asking advice from an academic counselor would be a great help before you take a CPA exam.

To learn more about your state requirement, visit ThisWayToCPA.com and choose your state for further details.

There are numerous professional organizations for accounting students. Not only will this help you find a job, but this step will also help you build your network and get involved with the accounting community. Here is a list of several professional organizations for accounting students:

Schools and universities that have prominent accounting programs usually conduct career fairs. Attending career fairs or programs is a great opportunity to build your network in the professional world. This is also a chance for you to explore companies and meet your prospective employer.

You can search for these career fairs online. They usually require advance registration, which you can do via online registration or phone call.

Merely attending these career fairs is not enough; you have to be prepared, too. Here are some tips on how you can prepare yourself for the event:

Searching for jobs in the accounting field is much easier these days because of the available job application sites. You can try the websites below in searching for job openings:

Finding an accounting firm that you would want to work for can be nerve-racking, especially when there are almost 140,000 accounting firms in the US as of 2019. Here is a list of the Top 10 Accounting Firms in The USA, according to The Big 4 Accounting Firms.

The salary is one of the major factors a person considers in finding a job. Accountants have one of the most secure jobs because as long as people are making money, they need accountants’ services. But, an accountant’s wage will vary from state to state due to several factors.

Here’s a list of an accountant’s average earnings in every state according to the latest data from the Discover Accounting dated 2019:

| State | 2019 Mean Annual Wage |

|---|---|

| New York | $98,650 |

| New Jersey | $83,430 |

| Rhode Island | $77,870 |

| Connecticut | $77,580 |

| Virginia | $77,320 |

| Massachusetts | $76,670 |

| California | $75,880 |

| Maryland | $74,850 |

| Delaware | $74,560 |

| Colorado | $74,400 |

| Washington | $73,660 |

| Alaska | $73,500 |

| Texas | $72,970 |

| Georgia | $71,720 |

| North Carolina | $71,100 |

| Illinois | $70,500 |

| Pennsylvania | $69,420 |

| Arizona | $69,050 |

| Minnesota | $68,130 |

| Oregon | $68,010 |

| Vermont | $67,270 |

| New Hampshire | $67,130 |

| Michigan | $66,810 |

| Ohio | $65,700 |

| Wisconsin | $65,430 |

| State | 2019 Mean Annual Wage |

|---|---|

| Indiana | $65,380 |

| Oklahoma | $65,280 |

| Alabama | $63,800 |

| Tennessee | $63,800 |

| South Dakota | $63,430 |

| Maine | $63,180 |

| Florida | $63,160 |

| Kansas | $63,130 |

| Utah | $63,100 |

| Missouri | $62,860 |

| Nevada | $62,590 |

| West Virginia | $62,470 |

| Iowa | $62,280 |

| Hawaii | $61,950 |

| Montana | $61,950 |

| Nebraska | $61,480 |

| Arkansas | $61,390 |

| North Dakota | $60,860 |

| Wyoming | $60,850 |

| Louisiana | $60,760 |

| Kentucky | $60,340 |

| South Carolina | $60,250 |

| New Mexico | $59,620 |

| Mississippi | $59,490 |

| Idaho | 58,700 |

Report from the Bureau of Labor Statistics

A well-crafted resume will leave a good impression on your prospective employer and it also plays a crucial role in getting noticed and remembered by the hiring manager.

Here are some tips to show your potential employer that you are the best candidate they have:

By now, you already know that a Certified Public Accountant (CPA) is the highest level and most popular certification in the industry, but there are also other certifications that will help you boost your chances of landing a job and be the cream of the crop

It is crucial to choose which certification/s are going to be included in your resume. Use the relevant certification to the position you are applying for as much as possible.

Also, the license and certification section in your resume should follow a certain structure:

Here are some other things to take note of:

Focus on your hard and soft skills essential in accounting. Soft skills may include critical thinking, leadership, problem-solving, time management, written communication, and oral communication.

Hard skills or technical skills can be your financial skills, advanced excel skills, business intelligence software knowledge, cloud computing experience, and knowledge on spreadsheets and software such as QuickBooks.

The content in this section of your resume should be short and snappy, but at the same time, persuasive. You can use the information below in writing your career objective:

Adding numbers to your resume will help the recruiter picture out how you are an effective and result-driven employee, plus it will also impress the hiring manager. You can quantify:

If you landed an interview for an accounting position, be prepared to answer the interview questions.

Here are some common interview questions for aspiring accountants and how you can best answer them:

Prepare to answer the “why” question. One question most interviewers ask is, “Why do you want to be an accountant?” The interviewer wants to know your motive in pursuing the career and why you are interested in the position. Thus, focus your answer on the future, such as your career goals.

“What was the biggest challenge you have solved in your accounting profession?” The interviewer wants to see how familiar you are with the industry and your level of experience when coming up for a solution to solve a problem.

“Which accounting software applications are you familiar with?” There are a lot of accounting software applications an accountant can use. The best way you can answer this question is by doing research on what software applications the company you are applying for is using. In case you are not that familiar with the software applications they are using, you can demonstrate to your interviewer that you are computer savvy. You can learn pretty quickly in different accounting applications.

Below are other common interview questions that your interviewer would probably ask:

Always remember to present yourself calmly and professionally when answering your interviewer’s questions. You should also project that you are a responsible, detail-oriented, and loyal employee.

Sharpen your skills in accounting by taking these top online courses

Skill Success has carefully curated and organized thousands of online video courses. Start your journey to becoming an accountant with these top online courses.