1. Overview: Job Responsibilities, Salary, and Common Requirements

2. A Comprehensive Guide to Becoming a Financial Manager

3. What Does a Financial Manager Do?

4. Signs You Should Consider Becoming a Financial Manager

5. How Do You Become a Financial Manager?

6. What are the Knowledge and Skills Needed to be a Financial Manager?

7. Popular Schools and Colleges in the U.S. for Aspiring Financial Managers

8. How to Get a Job as a Financial Manager

9. Learn About Geographic and Location Pay Differentials

10. Make Your Resume Stand Out

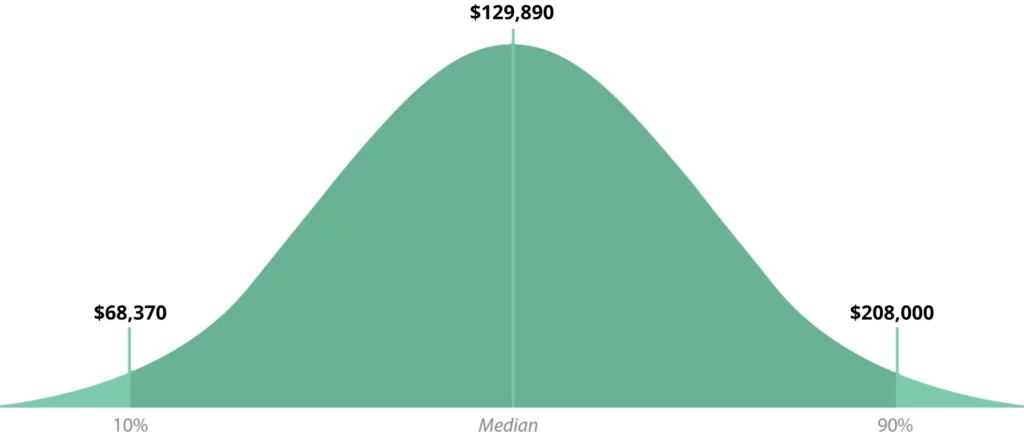

Financial Managers made a median salary of $129,890 in 2019. The best-paid 10 percent made more than $208,000 that year, while the lowest-paid 10 percent made $68,370.

Accountants and Auditors

Budget Analysts

Financial Analysts

Insurance Sales Agents

Insurance Underwriters

Loan Officers

Personal Financial Advisors

Quantitative Analysts

Credit Managers

Insurance Managers

Accounting knowledge

Communication skills

Interpersonal skills

Financial reporting

SQL

Xero

Budget analysis

Ever wonder how businesses reach their financial goals smoothly while making sure there are fewer mistakes along the way? Well, they run to the help of financial managers to maintain the overall financial health of the company. These financial saviors monitor the current status of the organization, and from there, they plan out the future financial engagements they are going to make.

Financial managers are highly in demand at the moment because every organization needs the helping hands of these financial professionals. In fact, according to the Bureau of Labor Statistics (BLS), the job outlook for the profession from 2019 to 2029 is 15%, which is faster than the average for any other profession. They also earn an impressive wage of $129,890 per year based on their 2019 median pay. What’s not to like? If you are waiting for that last push to pursue this profession, this could be it!

Financial managers function as the financial planners of any organization. They have a handful of tasks that revolve around making sure the business is financially intact and it is maximizing any income streams for the business to flourish.

A financial manager’s typical duties include the following:

Do you have what it takes to be a successful financial manager? Here is a short checklist of things you can start with on deciding to pursue the coveted role.

Although it is a primary prerequisite for every job to communicate well, landing a financial manager role will push you hard to develop your interpersonal skills. For developing your interpersonal skills you can take communication courses for upgrading your skills. You will be talking to a lot of different people coming from various levels of the organizational hierarchy–from the stakeholders to executives and down to the managerial roles and team members.

The role needs someone who will be able to translate well the complex financial terms and jargons into relatable statements which anyone in the business field can understand.

Well, being hired as a financial manager means you are good at handling your own money. A company will not entrust their business finances if you are not good at your own. If you are known to have a good credit and your friends ask you for financial advice, you can make the cut.

Being a responsible money-spender is a good sign of expertise in financial management, so keep your credit score well-maintained to prove your reliable in finances.

A financial manager faces grueling problems on a daily basis. If you are one to take pleasure in using your critical-thinking skills, then you won’t have any trouble in taking the job. The task calls for someone analytical who can keep up with the continuous flow of overwhelming responsibilities.

From negotiating deals with clients and stakeholders to finding the best strategies for the business, you shall embody a natural problem solver within you.

As the head of finances, you are going to spearhead the team on defining the best steps to take in earning more and making sure the business finances are in their best conditions. Also, you take every opportunity to know the whats, whys, and hows of every circumstance happening as you encounter them.

Your inquisitiveness will help you do well in finances as you are proactive in learning everything by yourself.

Are you one of those people who love imparting knowledge to others? Then being a financial manager might just work for you as they are tasked to pass down relevant information and processes to their team. A lot of times, they will be teaching the financial concepts to the organization they are in, so a gift for teaching is a plus for any aspiring financial manager.

As a financial manager, you will be planning and making the financial decisions of the business, so it is important to own the skill of effective planning. A successful financial manager can plan out the best ways to grow the company income and steer clear of any financial failures.

Anything that deals with finances is deemed to be stressful, so be prepared to be thrown in an environment where constant pressure is palpable. Though any highly classified profession carries the weight of a stressful job, one who aspires to be a financial manager has got to have the guts to take on any responsibilities thrown in his hands.

The job is not an easy task, so whoever wants to enter the field of financial management shall prepare himself to a world of complexities with highly gratifying returns.

To be a financial manager, one has to go through a series of requirements needed to be in the field. These will prepare any aspiring financial professional to get in their game once hired in the field.

This is how the typical path looks like for any aspiring financial manager:

To develop the needed expertise in financial management, the first step you should take is to finish a degree that relates to the subject of finance. There are a lot of programs one can choose from upon enrolling, but Finance, Accounting, Economics, Mathematics, Business Administration, and Management are your best bets.

Internships show your genuine interest in growing your portfolio as a budding financial professional, so make sure you take the opportunity to get at least one. These internship programs teach you the skills and knowledge not learned at the academe. You will be faced with the real-world examples of everything you are tackling inside the four corners of the room. Also, you will have the opportunity to create connections with potential employers.

Although it is not a requirement, a master’s degree in Finance, Accounting, Business Administration, Economics, or any Finance-related degrees will help you be ahead of other financial managers out there. Not only this looks good on your portfolio, but it also boosts your qualification as an effective financial manager.

As financial managers interact with the executives and stakeholders of a company, not anyone can easily secure the managerial role—especially those who are new in the workforce. It takes an ample amount of working experience in the financial field to work your way up as the manager.

You will typically start at the entry-level as an accountant, financial analyst, securities sales agent, and more before you get promoted to being a financial manager, which can be a controller, treasurers and finance officers, credit managers, cash managers, risk managers and/or insurance managers.

Getting certification strengthens your credentials as a financial manager. It is not a requirement to get licensed on a specialization, but it definitely helps to build up your professional expertise. These are some of the certifications you can get as a financial manager:

Financial managers need a set of strong skill sets that relate to their job as the head of finance. Here are the skills and knowledge any aspiring financial manager should instill to himself upon securing the job:

A financial manager is expected to have the capacity to communicate well with other colleagues due to the fact that he is holding a managerial role. A financial manager interacts with various people coming from the different levels of the organizational hierarchy, so it’s essential to be articulate in explaining financial complexities into a simple elaboration.

A financial manager’s role is very crucial in any organization as they spearhead the financial engagements of the company. You will encounter extreme troubles that will call for resolutions you need to make as you face them. A sharp mind and strong analytical skills should be innate to you as you are carrying a big responsibility on your shoulders.

As the lead of the finance department, you will be communicating with other departments to lay down information to make things work in the company. You will be needing to develop exceptional interpersonal skills in order to build a rapport with the said units. A good relationship with other people working in the company makes a financial manager’s work easier to relay concerns and resolve them.

Well, as a manager, a financial manager is expected to be able to run the finance department’s activities smoothly. He is leading his team on accomplishing the financial tasks of the whole company—a sense of direction and responsibility is a requirement to fulfill his duties.

One of the main tasks of a financial manager is to prepare the financial statements of the company. It is done for the benefit of the organization when doing internal financial reports to monitor the activities of the business. These financial statements will help the financial manager identify the next steps to do for the growth of the company in the coming months or years.

Budget preparation takes a big chunk on the roster of responsibilities a financial manager takes on. The budget of a company should align with the current goals and strategies of the organization. The financial manager’s task is to make sure the budget is in sync to these, and all the resources will be used efficiently during the timeframe given.

It is hard to fulfill the duties of a financial manager if the assigned person is not knowledgeable in even the basics of Accounting. This is a non-negotiable requirement for any aspiring finance professional as you are dealing with financial complexities on a daily basis. Subjects of the cash and accrual accounting, financial statements, cash flows, receivables, and payables are among the terms you have to be familiar with.

As the head of the finance or budget department, you also have the task of finding strategies to reduce costs and generate more income for your company. You should be able to keep up with the current market trends to identify which are worthy investments or strategies to roll out on your company’s financial goals.

In no particular order, here are the top 43 business schools in the US that excel in offering Finance degrees according to U.S. News & World Report.

So you’ve learned every detail you need to know in getting into the field of the financial world—where to next? Well, you now have to go on and start finding that perfect job for you! You won’t have much trouble finding a company for yourself as any enterprise that deals with finances (basically everyone) calls the need of a financial manager.

Here is a list of ways to find your job as a financial manager:

First things first, you should have your preferences that you will prioritize. After all, you have dream companies that you want to work for. You can look for job openings on these particular companies through their websites. That’s the easiest way to snag the role. Or you can also ask some connections who work for the same company and personally inquire for any job vacancy.

As someone who’s in the financial realm for quite some time, you may have now accumulated a number of professional and personal connections who can hook you up a job opportunity. These people who have worked with you or personally know you are a big help in referring you to companies that are hiring. Plus, you are personally tapped, which means there’s a high probability of being hired.

Considered it to be the easiest method of finding a job, online job websites offer you a wide selection of companies you can work for. These job openings posted online gives you an early glimpse of how your workload is going to look like so use that to your advantage by picking the best fit for you. Here are some of the most well-known job portals you can use to search for your next job:

A practical way to score a career opportunity is through attending career fairs. This kind of events happen once in a while, at every area there is, so it’s suggested to watch out for upcoming job fairs near you when you are on a job hunt.

These are some websites you can check out to know when your area is holding a career fair:

The annual salary of a financial manager is quite impressive, with a median salary of $129,890, one can enjoy the highly gratifying returns of doing the job. However, just like any other profession, the geographical area affects how much a financial manager makes. Here’s the mean annual wage of financial managers in 2019, according to BLS.

| State | 2019 Mean Annual Wage |

|---|---|

| New York | $210,240 |

| New Jersey | $177,410 |

| Delaware | $169,100 |

| Connecticut | $167,000 |

| Virginia | $165,600 |

| Colorado | $164,370 |

| Rhode Island | $161,880 |

| California | $156,500 |

| Massachusetts | $153,650 |

| Pennsylvania | $153,350 |

| North Carolina | $150,140 |

| Maryland | $149,930 |

| Illinois | $146,930 |

| Georgia | $145,750 |

| Texas | $145,750 |

| South Dakota | $139,620 |

| Wisconsin | $138,420 |

| Washington | $138,140 |

| Ohio | $137,890 |

| Minnesota | $137,100 |

| Kansas | $135,720 |

| Missouri | $135,120 |

| North Dakota | $133,980 |

| Florida | $131,000 |

| New Hampshire | $129,440 |

| Michigan | $129,380 |

| State | 2019 Mean Annual Wage |

|---|---|

| Alabama | $129,090 |

| South Carolina | $125,060 |

| Arizona | $123,220 |

| Hawaii | $122,780 |

| Oregon | $122,380 |

| Nevada | $121,520 |

| Wyoming | $118,900 |

| Indiana | $118,370 |

| Maine | $118,350 |

| Oklahoma | $118,370 |

| Maine | $118,350 |

| Oklahoma | $118,020 |

| Iowa | $116,590 |

| Nebraska | $116,450 |

| Tennessee | $113,700 |

| Kentucky | $113,070 |

| Utah | $114,000 |

| Alaska | $110,410 |

| Montana | $110,070 |

| Louisiana | $108,890 |

| Arkansas | $107,990 |

| New Mexico | $107,260 |

| Vermont | $105,160 |

| West Virginia | $89,99,620 |

| Idaho | $96,260 |

| Mississippi | $95,800 |

Report from the Bureau of Labor Statistics

You’re done with looking up your prospect companies, and now you are down to crafting that resume to amplify your chances of getting hired. Aside from the non-negotiables of creating a resume—sharp objective, relevant work experiences, education, and so on—here are some additional tips to make your resume stands out among a pile of other candidates’.

In your application to being a financial manager, it’s worth taking a look at the job requirements and job descriptions of the posting you are applying for. This way, you can ensure your skill set matches the requirements and you can align your resume to what the company needs.

Here’s how the job descriptions and job requirement template usually looks like:

We seek a highly skilled and reliable finance manager to join our growing company. In this job, you will play a vital role in monitoring the financial activities of the organization while providing the needed guidance to the upper management on financial planning.

The financial manager’s goal is to help the company’s leaders to create sound business decisions and materialize the company objectives.

A roster of certifications and licenses instantly boosts your resume as this shows how adept you are in financial management. Your hard-earned titles won’t go into waste as these are highly preferred by employers. So to polish your resume, make sure to add each certification you have and supply little details about when you got it and what its specialization is. The more you can list down; the more impressive your resume is going to look.

Here is a list of certifications a financial professional can pursue to boost his credentials:

It’s a given that you already have worked prior to jumping up a notch to become a financial manager so you have good options as to who you are listing down as your character reference. Former colleagues and superiors you have worked with closely during your previous jobs fit perfectly as references because they can provide the precise work ethics you have. Just make sure as you put them in your resume, you have their permission to have them asked by any possible employer.

An employer will lose interest if you have written down things in chronological order. Remember, they want to find out the latest happenings in your career. They also want to see the growth of your career over time, so be sure to put in all the relevant working experiences, trainings, seminars, and educational background that will strengthen your employability.

Finally, you have secured that awaited interview! What to do now? Well, of course, you have to prepare answers for possible questions to be asked on you. This is not your first time to attend an interview, so you know how the drill works. You are going to get asked about yourself, what you did in the past, and your future career plans—we’ll skip those. Instead, we are going to focus on the main points of the interview that relate to the job.

Here are the possible questions you should prepare for your financial manager interview:

This question is one of the first questions to be thrown at you to warm things up. The employer wants to know how much you understand your role as the lead of the financial planning process of the organization. So give them just what they need.

Tell them your knowledge and experience gained in the past responsibilities you have handled and identify your methodology in planning the finances of a company. This question warrants your understanding of the role so be elaborative and honest on how you are going to tackle the responsibilities.

Any similar question that asks about how well you communicate well with coworkers and external units demands an answer to your ability to build rapport within the business. As a financial manager, you will be dealing with a bunch of departments you have to talk to. Keeping a harmonious and effective communication within and outside the organization is one of your key tasks, so give examples of how you create rapport with them.

Every employer seeks for someone who has exceptional planning skills—after all, your main job is to plan the financial activities of a company. Show them your skill set by identifying your methods and giving details about how you run them down. Just keep in mind that in order to successfully answer this inquiry, you shall be able to display your dexterity in planning.

Being a financial manager calls for the need to be in the loop of technological advancements that will make his work easier. Understanding the technical aspects of finances, a financial manager will learn how to use financial management software like QuickBooks, Kissflow Finance & Ops Cloud, Zoho Finance Plus, Xero, Oracle Financials Cloud, Sage Intacct, and many more.

As a leader of the team, you ought to develop good leadership skills and a sense of recognition for your team members. This question wants to know how you serve as a leader and how you give credit where it is due. Answer the question with your leadership techniques, communication and reward initiatives, and motivational strategies to show how you tick as a leader.

Those are just some of the potential questions that can be asked to you aside from the common interview questions. Just freely answer them with integrity to exude genuineness. Sit up and be confident in working up answers to prove your eagerness to land the job. That’s what the employer will want to see from you aside from your credentials.

Sharpen your skills in finance management by taking these top online courses

To gear you up on becoming a financial manager, here are some of the top online courses from Skill Success you can take that specializes in financial management: