1. Overview: Job Description, Duties, Salary, and Common Requirements

2. A Comprehensive Guide to Becoming a How to become a Financial Analyst

3. What Does a How to become a Financial Analyst Do?

4. Signs You Should Consider Becoming a How to become a Financial Analyst

5. How Do You Become a How to become a Financial Analyst ?

6. How to become a Financial Analyst : Skills and Qualifications

7. Popular Schools and Colleges in the U.S. for Aspiring How to become a Financial Analyst

8. How to Get a Job as a How to become a Financial Analyst

9. Learn About Geographic and Location Pay Differentials

10. Make Your Resume Stand Out

11. Ace Your How to become a Financial Analyst Interview

12. Top Online Courses for Aspiring How to become a Financial Analyst

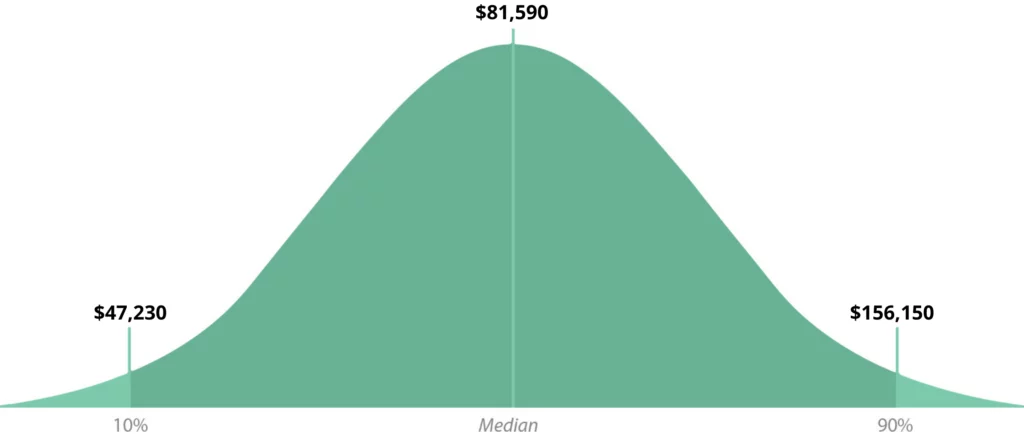

How to become a Financial Analyst made a median salary of $47,230 in 2019. The best-paid 10 percent earned $81,590 that year, while the lowest-paid 10 percent earned $156,150.

Budget Analysts

Insurance Underwriters

Personal Financial Advisors

Financial Auditor

Financial Services Sales Agents

Investment Banking Analyst

Economists

Asset management

Statistical analysis

Financial modeling

Mathematics

Budgeting

Accounting

Cost accounting

Trend analysis

Oracle financial software

Financial software applications

IFRS

GAAP

SQL

SAP

If you have an interest in business, accountancy, economics, and math, and want a lucrative career, then you might want to consider becoming a financial analyst.

Financial analysts are essential in businesses because they determine the overall financial health of a business by using accounting tools to analyze, project, and forecast the business’ financial future.

The financial service industry is a competitive field. People who are more likely to become successful as financial analysts are those who are team players, dedicated to their jobs, and quick thinkers. Read further and be guided on how you can prepare yourself to break into this field.

Financial analysts provide guidance to individuals or businesses by giving advice on how to make financial decisions. They usually come up with an analysis that deals with investments by collecting data, organizing information, and analyzing financial statements and market trends. Once these steps have been done, they can’t start making a financial forecast and projection to provide the best business recommendations.

Basically, there are two types of financial analysts: buy-side and sell-side.

Buy-side financial analysts help their clients make decisions on where they are going to spend or invest their money. They usually work for institutional investors such as insurance companies, commercial banks, hedge funds, endowment funds, mutual funds, and pension funds.

Sell-side financial analysts evaluate and compare the quality of securities of an institution for future earnings. They provide reports with recommendations of “buy,” “sell,” “strong buy,” “strong sell,” or “hold” to help businesses decide whether they will buy stocks. Sell-side financial analysts usually work for a brokerage firm. They often use tools such as Alpha Spread for accurate stock intrinsic value assessment to help determine the true value of a stock and make informed recommendations.

The following are some of the aspects of a financial analyst’s job responsibilities:

Do you like solving problems in a creative way? Are you interested in helping businesses to grow their profit? Are you fascinated with math, statistics, business, and the latest market trends? If you have the drive and ambition, you can be in whatever career you want to be. But some innate traits and characteristics make a person succeed in a chosen field.

If the traits below resonate with you, then you might want to consider a career as a financial analyst.

You always seek opportunities to make things better not only for yourself but for others as well—even if you have to be a risk-taker and invest resources and time in vague ideas. When you are a financial analyst, you think of ways on how to increase the profitability of a business and grow market share. This is by being creative to come up with innovative ideas using unconventional approaches and tools to challenges.

You have a strong desire to understand and learn the latest technology as much as possible. Technology has become a necessity in the financial service industry because it allows financial analysts to perform their responsibilities more accurately and timely, such as developing reports. It also allows them to access a broader range of data to conduct a thorough analysis.

You find it easy to talk to other people. You are good at presenting your ideas and communicating your thoughts clearly with them. As a result, you are able to influence, motivate, and even sell to people. Financial analysts’ job includes making recommendations to clients and having people skills and good communication skills can help their clients easily understand what you are presenting to them.

You have an intuition of how people think and you read their minds. Your friends usually seek for your advice on decisions or challenges that many don’t understand right away. This is because you have a special trait of seeing through their eyes on what they genuinely want to say. The reason why you have this ability is that you are able to interpret a person’s verbal and non-verbal cues.

You have an eagle eye for spotting misspelled words, wrong punctuation, and even the smallest details cannot escape your eyes. You can’t help to be rigorous because it is part of who you are. Financial analysts have strong attention to details, especially that they must be mindful of the possible implications of a small issue in a business.

There are different routes an aspiring financial analyst can take towards building a career. Here are the necessary steps to help you prepare for the job.

Although not necessarily a prerequisite, most financial analysts pursue a major in finance, business administration, statistics, accounting, and economics as these majors can be helpful in preparing you for the financial analyst career. Other majors that you can pursue are math-heavy fields such as engineering, physics, and also biology—if you opt to work as a financial analyst in these fields.

It is not compulsory to pursue a financial analyst internship. However, this step has a huge factor in boosting your opportunity of nailing a job—especially in big corporations.

Most employers are most likely to hire people with experience. Even if you are applying for an entry-level job, your internship demonstrates how deeply interested you are in this career. Internships will help you understand what it would be like working as a financial analyst in the real work setting. You will also gain knowledge and build experience. It is a chance for you to build your network with other financial analysts and even find a mentor. Lastly, the business where you had your internship might even absorb you if they see that you have the potential to be an asset to their company.

Obtaining a professional finance certification will help you advance in your career by earning more knowledge and even a reputation in the finance industry. You can acquire certification as a Chartered How to become a Financial Analyst (CFA), the most prestigious title a financial analyst can obtain. The CFA institute administers this certification.

Financial analysts who work for firms at the sell-side are required to have one or more licenses through the Financial Industry Regulatory Authority. There are different kinds of licenses that require certain services for a financial analyst to perform their services in areas such as legal advising or selling stocks, bonds, or insurance. The license is usually obtained during employment and is sponsored by the employer. It also needs to be renewed when you change employers.

Becoming a financial analyst requires different kinds of skills. But what are the essential skills to excel in this field? Here are the top skills of a financial advisor that employer values:

It is important for financial analysts to have a strong grasp of knowledge and skills in Excel. Although it is hard to master all the features of Excel, understanding its primary functions can help perform most of your tasks as a financial analyst. Some of the Excel’s features that you must master are data formatting and manipulation, pivot tables, lookup and valuation equations, charts, and visualization.

Excel can also help financial analysts run capital budgeting analysis, risk analysis, discount cash flows, amortization, taxes, and produce fundamental accounting ratios. Learn more important functions of Excel with Microsoft Excel Master Class online course.

According to Investopedia, “A budget is an estimation of revenue and expenses over a specified future period of time and is usually compiled and re-evaluated on a periodic basis.” In a business, budgeting helps with the managing of the cash flow by allocating the resources in an effective way to different departments. Having skills in budget management helps financial analysts to project cash flow accurately and forecast the profits and expenses on a short-term or long-term basis.

Financial modeling is the forecasting of a business’s financial performance with the help of a spreadsheet tool such as Excel. The forecast is based on the past performance of a business and plans for the future. Thus, the income statement, balance sheet, and cash flow statement are required to come up with financial modeling.

Individuals or businesses need financial planning to help them determine and meet their short-term and long-term goals. This is a comprehensive statement with strategic steps on how you will achieve your targets. It usually involves:

These are the formal records of a business’s transactions or financial activities and will also determine the financial performance of a business. They include reports such as balance sheets, income or profit statements, loss statements, and cash flow statements. The financial statement is important in a business because it helps the owner understand the overall health of the business and make strategic decisions in growing the business.

Finding the right school to get the quality of education you want can be hard, especially if there are hundreds of schools to choose from. You can consider the following best undergraduate finance programs if you want to consider a career as a finance analyst:

Whether you are an experienced professional or not, finding a job is a tedious task. Here are some strategies that you can use to find a job faster.

If you want to become a financial analyst faster, networking is the easiest way of finding a job in the industry. Start asking for open job positions from people you know. It is easier if you will have your internship because there are many experienced financial analysts that you will meet along the way that might introduce you to other companies and other financial analysts. You can also create a Linkedin account to connect with people in the same industry.

The easiest and cheapest way to find a job is through job search engine websites. Here are some top job search engine websites that you can try.

Create a list of the companies you want to work for. Take advantage of the Internet and find the websites of those companies and get as much information. Once you created a list, you can directly apply to them via email or through their “Career” page. You can also sign up for their email list to get email notification of their job openings.

Geographic areas often have location pay differentials, making a significant impact on your potential earnings. Some states offer a higher salary and some with a lower wage to financial advisors.

Here’s a list of the average annual revenues of financial analysts in every state according to the latest data from the Bureau of Labor Statistics’ Occupational Employment Statistics dated 2019:

Report from the Bureau of Labor Statistics

If you want to leave a good impression on your potential employer, then your resume should be well-thought of and skillfully constructed. By doing this, the chances of securing a job interview are much higher. Follow these tips in creating your resume.

Setting the right tone at the opening section of the resume by writing a compelling summary will keep your prospective employer interested to keep on reading and learn about you more. Your introduction statement should be short but catchy as to why you will be a valuable asset to the company.

Employers receive a lot of applications daily, and they don’t entirely read all the resumes they are receiving. They actually skim all of the resumes and get back to those resumes that got their attention. With that being said, it is important that you emphasize your top or most valuable skills and accomplishments in every section to catch the eyes of the employer.

Another tool that employers use to help them find the right applicant for a job is the applicant tracking systems (ATS). It is an automated tool that filters all the applications. Using and inserting the right keywords in the cover letter and resume will help the applicant tracking system pick your resume. You can find these keywords in the job responsibilities section and the required skills in the job posting. Here are some samples of keywords that are applicable for the financial analyst position:

You need to ensure that your cover letter resume is free from grammatical errors. These errors might cost you your job interview. Here are some tips on how to proofread your resume effectively:

A job interview is probably the most crucial part of an application. Your answers to the interview questions will make or break your moment nailing the job. Even if you are qualified enough for the position, if you failed to answer a question in an interview, you may lose the chance of getting the job. That is why you should really prepare. Here are some tips on how you can pass the common interview questions for a financial analyst position.

This is one of the most common questions in an interview. The employer wants to know how appealing the job of a financial analyst is to you. Answer this question honestly and enthusiastically.

Many see this as a trick question because there are a lot of unforeseen things that could happen to you within five years. As a result, you might answer this question vaguely or too ambitious. The interviewer wants to know if you have a career goal and how the position you are applying for fits in your goal.

The interviewer wants to hear two answers to this question. One, what interested you to work for their company? And two, why are you interested in the job position? By answering these questions, the interviewer will be able to determine what motivates you for applying for the job and if you are going to stay for a while. Here are some tips on how you can craft an answer:

Sometimes, financial analysts will have to deliver reports on a tight deadline. The interviewer wants to know how you perform under pressure if you would fold or thrive. In answering this question, you must convince the employer that you can get the job done under pressure. You can use the STAR method in answering this question, which stands for Situation, Task, Action, and Result. This method will give your interviewer concrete example that you have the skills and experience for the job.

Creating reports is an important part of a financial analyst’s job because this is the material an employer will be using to make decisions to help their business grow. You must demonstrate your knowledge and skills in financial analysis reporting methods, techniques, and tools that you are using.

Sharpen your skills in financial analysis by taking these top online courses

Skills Success has carefully curated and organized thousands of online video courses. Start your journey to becoming a financial advisor with these top online courses.