1. Overview: Job Responsibilities, Salary, and Common Requirements

2. A Comprehensive Guide to Becoming a Financial Advisor

3. What Does a Financial Advisor Do?

4. Signs You Should Consider Becoming a Financial Advisor

5. How Do You Become a Financial Advisor?

6. What are the Knowledge and Skills Needed to be a Financial Advisor?

7. Popular Schools and Colleges in the U.S. for Aspiring Financial Advisors

8. How to Get a Job as a Financial Advisor

9. Learn About Geographic and Location Pay Differentials

10. Make Your Resume Stand Out

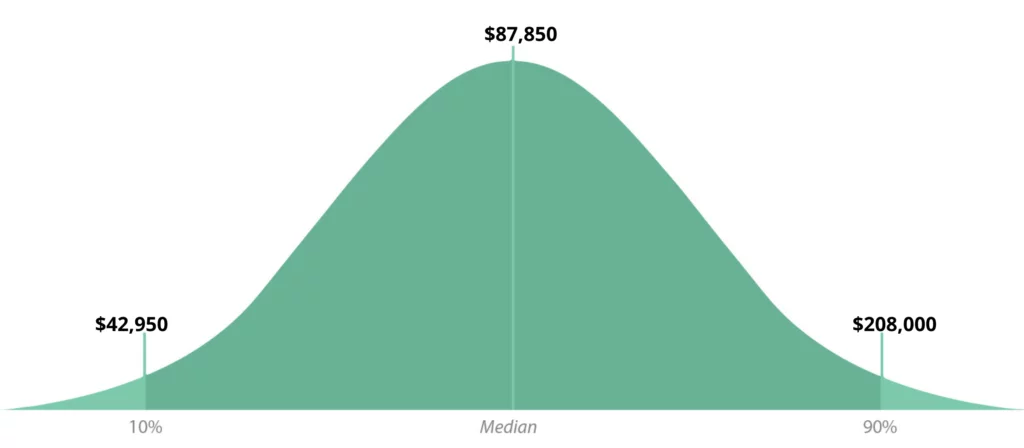

Financial advisors made a median salary of $87,850 in 2019. The best-paid 10 percent made $208,000 that year, while the lowest-paid 10 percent made $42,950.

Budget Analysts

Financial Analysts

Personal Banker

Real Estate Broker

Insurance Sales Agents

Insurance Underwriters

Investment Analyst

Pensions Consultant

Management Consultant

Communication, interpersonal and listening skills

Customer service skills

Organizational skills and attention to details

Time management skills

Good level of numeracy skills

Decision-making skills

Ability to make complex ideas understandable

Trustworthy and reliable

According to Best Jobs US News Rankings, the financial advisor career was sixth in best business jobs, the twenty-second in best paying job, and thirty-first in best 100 jobs in the US. Based on the data from the US Bureau of Labor Statistics, the median salary of financial advisors is $87,850 per year or $42.24 per hour. Also, the job outlook of this lucrative career is expected to grow 4% (as fast as the average of all occupations) from 2019-2029.

The main reason is the rising employment growth and the rising of the aging population in the US. There is an impending senior surge, and it is estimated that by 2035 there will be about 78 million people that will be over 65 years of age. These baby boomers turn to financial advisors to ask for advice in preparation for their retirement.

Despite the emergence of “Robo-advisors” that is popular with the millennials, the traditional financial advisor will still be in demand as there will always be a need for human advisors, especially in advising on more complex investments.

Financial advisors help individuals or companies achieve their financial goals. They work independently or employed by a financial firm. Most people seek help on how they will handle their money wisely. That’s when they turn to a financial advisor’s experience and skills in guiding them by giving pieces of advice including but not limited to investments, insurance decisions, college savings accounts, retirement, and tax laws.

Financial advisors are also known as:

The job responsibilities may include:

Just like any other career out there, becoming a financial advisor.

PROs:

CONs:

If you are planning to start a new education or career journey, there are points that you need to consider. Of course, your happiness, marketability, and priorities are just some of your considerations. But there are also signs that you should also use as a basis in finding your true calling. Do you want to know if the financial advisor career is the right path for you? Here are some signs you might want to consider financial advising.

You love to be around people and hear their past stories, experiences, and future plans. You get along with people well, and they find you easy to talk to. As a result, you are able to build a deep connection and get to know them on a personal level.

As a financial advisor, your responsibility is to meet and communicate with clients. This is so that you get to know them and provide the right financial and investment opportunities.

Planning, setting goals, and organizing your calendar are important to you. As a financial advisor, you should establish short-term and long-term plans when it comes to investing money. You know that when it comes to money matters, it pays that you create a balanced plan ahead to meet your financial goals.

You want to make a difference in people’s lives in terms of contributing to the growth of their financial health. You wish for people to live a life with no worries to their own and their family’s future and that they will someday retire happily and comfortably.

You should consider the financial advisor career if your friends and other people who are close to you are always asking you for money-related matter advice. Trustworthiness and reliability are important traits of a financial advisor. If they trust you and feel comfortable putting their financial matters into your hands, then you are perfect for this career.

Just like any other job, becoming a financial advisor is not that easy. You must go through rigorous education, training programs, and obtain certifications for you to fulfill the responsibilities successfully. The process may also vary depending on the kind of financial advising or planning you want to pursue. Here is a step-by-step guide to becoming a financial advisor.

A bachelor’s degree is needed if you want to become a financial advisor. Although there is no required specific major, it would still be helpful if you take coursework in finance, investments, accounting, economics, business statistics, and other related fields.

Having a Master of Business Administration (MBA) degree, as well as a degree in legal studies or law, will give you an edge and increase the chances of employment.

Undergoing a financial advisor internship is a proven way to get your feet wet and obtain the relevant skills, knowledge, and experience as a financial advisor. Another benefit is that you can establish important connections along the way and gain mentorship working in this field.

There are different kinds of certifications and licenses available for a financial advisor. The current job and services you are providing will help you determine what certifications and licenses you can take. For example, you want to focus your financial advising on selling investment products; then, you must register and pass the examinations regulated by the Financial Industry Regulatory Authority (FINRA). The typical license exams may include:

Here are the top 10 financial certifications for aspiring financial advisors:

Visit the following websites to find out more information about financial advisors:

Becoming a financial advisor requires different kinds of skills. But what are the essential skills to excel in this field? Here are the top skills of a financial advisor:

Analytical thinking is the ability to solve problems efficiently and quickly. It involves using methodical steps by:

Financial advisors should apply these methodical steps in analyzing the financial needs of their clients and by determining the particular solution to the client’s problems.

You have the skills to receive and give information accurately and clearly. To become an effective communicator, you must practice your skills in active listening, speaking, observing, analyzing, and empathizing during communication.

As a financial advisor, you must have excellent communication skills so that you could thoroughly understand the needs of your client. Also, you can clearly explain your financial plans to them and to avoid misunderstanding.

This skill is essential in the career of financial advisors. This is because they are dealing with different sorts of financial data, reports, and plans. If you have organizational skills, you have the mental capacity that allows you to handle those resources efficiently to achieve your desired result. Organizational skills involve:

There are challenges in the financial advising industry that financial advisors are facing in their line of work. This field is a high-stress environment, especially for financial advisors who are just starting in their career. They need to manage their clients’ portfolios, maintain constant communication, and assist clients in making major decisions financially that will have a huge impact on their lives.

You must have knowledge and understanding of various taxes, accounting transactions, recording of accounting, accounting regulations, preparation of financial statements, budgeting, and other accounting-related matters. You should also know how to use accounting software to help you with your financial record keeping efficiently.

Education plays an important role in becoming successful in your career. The time a student spent in school helps them hone their skills that they can use in their future career. Finding the right school can be overwhelming because there are hundreds to choose from. Here are the best colleges for aspiring financial advisors in 2020.

The U.S. Bureau of Labor and Statistics projected that the employment growth of financial advisors from 2019-2029 would grow seven percent. In 2019, the number of financial advisor jobs was 264,000. Like other careers, there are certain states in the U.S. that are employment hotspots for financial advisors. If you visit the next section of this guide, you will discover that the best employment opportunities are in New York, followed by Wyoming and Maine.

If you are serious in pursuing this career and get a job as a financial advisor, you might want to consider the following tips to find a job faster.

Finding job postings is easier and faster when done online. You can try the job search engine sites listed below in finding job vacancies for the financial advisor position.

When you sign up to most of the job search engine sites, you will be able to create an account and upload your resume, making this information visible to recruiters who are finding candidates to fill a position.

Connect with everyone you know, as well as those who know people who are in the field as a financial advisor. Your connections are as important as your qualifications. Your network can provide you inside scoop of what it is like working in their company. They might also offer you details of the available jobs and hiring process. Furthermore, they can help pull some strings by recommending you and giving your application a closer look by the recruiter or hiring manager.

You can find almost everything that you want to know about a company online. This is by researching the companies you would like to work in to build a target list. These companies will most likely have an open job position that fits your interests and values.

Geographic areas often have location pay differentials, making a significant impact on your potential earnings. Some states offer a higher salary and some with a lower wage to financial advisors.

Here’s a list of the average mean of annual revenues of financial advisors in every state according to the latest data from the Bureau of Labor Statistics’ Occupational Employment Statistics dated 2019:

Report from the Bureau of Labor Statistics

A well-crafted resume leaves a good impression on your prospective employer to show your suitability for the position so that you can get them to set an appointment with you for an interview. Follow these tips in creating your resume.

It will help if you make an effort to give your potential employer an idea about your skills and experiences to show that you are the best financial advisor in your objective statement. To come up with a strong objective statement, you need to research the job requirements to see what they expect from the candidate. The objective statement does not need to be lengthy. Here is an example:

Optimistic and energetic individual with a strong desire to occupy a financial advisor position at <name of the company>. Offering exceptional financial planning skills and a strong ability to handle and resolve financial issues.

Most resumes should be one to two pages only. With being said, you only have limited room to tell a story to the recruiter about yourself. Instead of using paragraphs, your (professional work) story should be in bullet points. This is so that the employer can easily and quickly identify your key facts.

There are hundreds of job applications the human resources are receiving, especially in big companies. That is why many companies are using automated applicant tracking systems (ATS) in filtering their applicants. One technique to get your cover letter and resume noticed is to add keywords.

Resume keywords are words or short phrases that are related to the job posting, such as those in skills, experiences, credentials, and other qualities the company is looking for a financial advisor. You can use the following finance keywords that are applicable for the financial advisor position in your resume:

Most applicants find it difficult and stressful to write their resume. Even if you know that you have done an excellent job under your previous employer and you were deemed a valuable employee, conveying it on your resume can be hard. You can refer to different financial advisor’s resume samples or templates to give you an idea of what to include on your resume, as well as how to customize it and include only useful details.

Even the smallest mistake in your resume can make a significant impact on your application negatively. That is why you should proofread your resume before sending it to the recruiter of the company. Here are some tips on proofreading your resume:

When you are applying for a financial advisor position, you need to make sure that you are prepared to answer the interview questions. Practicing our sample interview question and answer will help you proceed to your interview appointment with confidence.

An important part of being a competent financial advisor is obtaining and maintaining loyal clients. What the interviewer wants to know are the methods you are using in getting to know your clients and how you build rapport with them so that you can establish trust. When you establish a great relationship with your clients, chances are they will stay longer, and you are more likely to become successful.

Your knowledge, skills, and experiences are important factors in becoming a financial advisor. It will be best if you highlight the education you’ve completed, experiences you’ve undergone, and certification or licenses you have obtained that would help you do exceptionally well in their company. Your answers will help the interviewer gauge how prepared you are for the role.

Being involved in a difficult situation with another individual is unavoidable in the world of business. There will be a point in the life of a financial advisor that a client will be unsatisfied with their service. The interviewer wants to picture out how you behave under pressure, how you deal with difficulties, and how you show what kind of person you are with your communication style.

You can answer this question using the STAR interview answer format or by giving real examples. Talk about your actions and approach, as well as the positive outcomes. Don’t forget to also emphasize your communication and problem-solving skills.

The interviewer wants to assess your integrity and how well you can communicate with an actual client in person. In responding to this interview question, you also need to pay attention to the tone of your voice, speech delivery, and body language. Plus, you need to show your confidence and professionalism.

This is the best time to sell yourself by demonstrating your skills, knowledge, and experience–not only in the field, but your understanding of the position and company.

Before you construct your impressive response, you might want to follow these steps to craft your answer thoughtfully:

Sharpen your skills in finance by taking these top online courses

Skill Success has carefully curated and organized thousands of online video courses. Start your journey to becoming a financial advisor with these top online courses.